arizona estate tax exemption 2019

While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

Arizona Inheritance Laws What You Should Know Smartasset

All of the rules in the 2010 tax law were scheduled to end on January 1 2013 unless Congress acted to extend.

. The lifetime exemption amount is the same as the estate tax exemption amount. There is also an annual exemption of 16000 per person. The following information accompanies a presentation Mike gave to members of the Arizona Commercial Mortgage Lenders Association ACMLA on March 12 2019.

See where your state shows up on the board. Federal law eliminated the state death tax credit effective January 1 2005. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

All Extras are Included. This page discusses various sales tax exemptions in Arizona. If youre married you and your spouse can leave up to 11 million to your heirs without qualifying for the estate tax.

Sales Tax Exemptions in Arizona. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Property Qualifying for the Arizona Homestead.

Some examples of exceptions to the sales tax are. As of 2021 the exemption sits at 2193 million and the top tax rate is 20. 117 million increasing to 1206 million for deaths that occur in 2022.

If children under 18 years of age reside in the household income cannot exceed 38926. First the states 2 million exemption was indexed for inflation on an annual basis. If an estate is worth 15 million 36 million is taxed at 40 percent.

A federal estate tax is in effect as of 2021 but the exemption is significant. Arizona also allows exemptions for the following. The Estate Tax is a tax on your right to transfer property at your death.

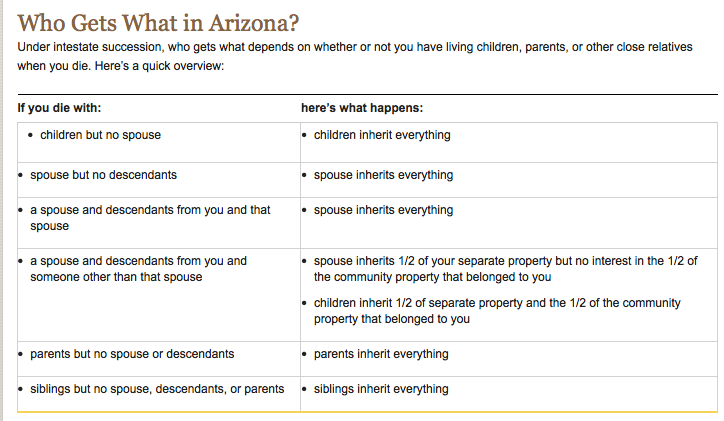

Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005. If your net worth is greater than 11 million or if your net worth is on the rise and may cross the threshold before you pass away you. AZ Rev Stat 14-2402 2019 14-2402.

The Tax Cuts and Job Act signed into law by President Donald J. An eligible city is regarded as performing a governmental function in carrying out the purposes of this chapter and the eligible project is considered to be municipal property for the purposes of article IX section 2 Constitution of Arizona. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

The current federal estate tax is currently around 40. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. As of 2006 Arizona no longer levies an estate tax.

In Arizona it doesnt matter whether a single person or married couple claims an exemption on a homesteadthe property will be exempt only up to the 150000 maximum homestead amount. While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation. The exemption continued to increase annually until it matched the federal estate tax exemption in 2019.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Starting with the 2019 tax year Arizona allows a dependent credit instead of the dependent exemption. Up to 25 cash back Arizona is not a state that will allow a married couple to double the homestead exemption amount.

Go Paperless Fill Sign Documents Electronically. Then the estate tax rates for the top four brackets increased by one percentage point. The size of the estate tax exemption meant that a mere 01 of.

The taxpayer or their spouse is blind. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Finally certain family-owned businesses received an estate tax exemption of up to 25 million.

Trump on December 22 2017 raised the federal estate tax exemption to 11180 million per person which. The estate tax exemption is adjusted for inflation every year. A decedents surviving spouse is entitled to a homestead allowance of eighteen thousand dollars.

Estate and inheritance taxes are burdensome. This exemption rate is subject to change due to inflation. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. Household income from all sources cannot exceed 32447.

There is currently no content classified with this term. The fair market value of these items is used not necessarily what you paid for them or what their values were when you. 2019 Arizona Revised Statutes Title 9 - Cities and Towns 9-625 Tax exemption.

All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. While the estate tax is not an inheritance tax as it is paid to the federal government by the estate and not the heirs such a tax can reduce the amount of money heirs receive. 2019 Arizona Revised Statutes Title 14 - Trusts.

100 Free Federal for Old Tax Returns. Premium Federal Tax Software. In 2017 the IRS has set the individual estate and gift tax exemption at 549 million.

2013 Estate and Gift Tax Law Changes. For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Ad Prepare your 2019 state tax 1799.

The taxpayer or their. The current federal estate tax is currently around 40. If you own property in those states or have heirs.

If there is no surviving spouse each minor child and each dependent child of the decedent are entitled to a homestead allowance of eighteen thousand dollars divided by the number of minor and. Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. This means the property assessment usually equates to a 264580 LPV property valuation.

The federal inheritance tax exemption. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025.

Arizona Case Law Property Tax Exemptions. Your Total Assessed Valuation see definition above in Arizona cannot exceed 26458. This is the same yearly exemption amount for federal tax purposes.

But there are states that do impose a state-level estate tax. The federal estate tax exemption for 2022 is 1206 million. If such an election was made her husband would then be able to leave 8000000 estate tax-free by using his own exemption of 5000000 plus his deceased wifes unused exemption of 3000000.

Arizona Death Penalty Information Center

Tax Information Arizona State Retirement System

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Inheritance Laws What You Should Know Smartasset

Home Buyer S Road Map Home Buying Process Real Estate Information Home Buying

Estate Planning Lawyer Chandler Az Keystone Law Firm

Terraced Patio To Lawn Modern Spanish Home Flat Roof Design Contemporary Exterior

Arizona Inheritance Laws What You Should Know Smartasset

Two Days Left To Pay Second Instalment Of Advance Income Tax For Fiscal 2019 Income Tax Senior Discounts Income Tax Return

What S The Arizona Tax Rate Credit Karma

Arizona Income Tax Calculator Smartasset

Arizona Felony Sentencing Chart

What Happens If There Is No Will In Arizona How It Works

Revealed Republican Led States Secretly Spending Huge Sums On Execution Drugs Capital Punishment The Guardian

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Arizona Death Penalty Information Center

What Is Arizona Homestead Act 5 Most Common Questions Answered